Market participation and tax-deferred growth can help accumulate wealth over the long term.

EliteDesigns offers investment options from some of the industry’s most well-known money managers. This expertise can help diversify your portfolio according to your unique wealth accumulation objectives and risk tolerance — from conservative to aggressive.1

Choose to manage your own assets or work with a trusted registered investment adviser.

Unlike fixed rate products, you have the ability participate in the market, which means greater potential for returns that may help meet or outpace the rate of inflation. Your financial professional can help you determine if the EliteDesigns Variable Annuity can complement your investment portfolio.

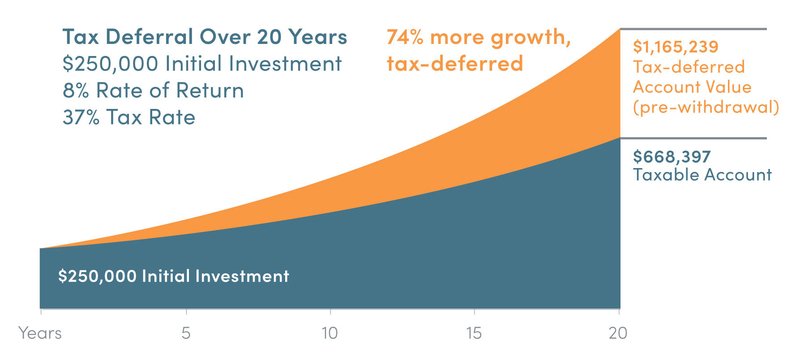

The Power of Tax Deferral

By deferring taxes on the returns of your investment, you can benefit in two ways:

- Tax-free growth — your gains are not taxed until withdrawal, which means 100% of those gains are compounding over time.

- As a retirement savings vehicle, many typically wait to take withdrawals until they’re in retirement. For many Americans, that’s a time when they may be in a lower tax bracket.

While qualified plans like a 401(k) or IRAs can also offer the advantage of tax deferral, you do have contribution limits. With EliteDesigns, you can invest as much as $1 million and potentially more into your contract. Keep in mind that investing in a variable annuity through a tax-qualified contract, such as an IRA, offers no additional tax benefit.

Below is an example of how a tax-deferred portfolio can help accumulate wealth faster than a similar portfolio that’s been taxed along the way. This example shows 74% more growth on a tax-deferred portfolio over a taxable portfolio.

SOURCE: First Security Benefit Life Insurance and Annuity Company of New York, March 1, 2021. The example above assumes an initial investment of $250,000 with investment earnings of 8% and a federal income tax rate and short-term capital gains tax of 37% and does not reflect the effect of any state taxes. These returns are hypothetical and in no way relate to the actual performance of any investment. The investment return on any particular product may differ substantially. Tax rates and tax treatment of earnings may impact comparative results. The example does not reflect the deduction of the EliteDesigns annuity fees including, mortality and expense risk charge of 0.20% (for contracts with a value over $500,000, the M&E is waived); annual administration fee of 0.25% on all subaccounts; an average fund expense of 1.12%, or the 0.35% optional Return of Premium Death Benefit fee. If such fees were deducted, the values illustrated would be reduced. It is important to note that while taxes on amounts invested in an annuity are deferred until withdrawn, upon withdrawal, tax-deferred performance would be reduced by income taxes on gains. Withdrawals are subject to ordinary income tax and, if made prior to age 59½, may be subject to a 10% IRS penalty tax. Conversely, earnings from investments that do not offer tax deferral are taxed currently, and withdrawals from such an investment are not subject to the penalty tax. Lower maximum tax rates on capital gains and dividends would make the return of the taxable investment more favorable, thereby reducing the difference in performance between the accounts shown. Some situations such as your personal investment horizon and income tax brackets (both current and anticipated), changes in tax rates and tax treatment of investment earnings may impact the results of this comparison. Each person’s situation is different, so these and other considerations must be taken into account when making an investment decision. For illustrative purposes, an income tax and short-term capital gains tax rate of 37% has been used; however, a person’s tax rate will likely change over the course of a 20-year period.

Does EliteDesigns offer a Death Benefit?

EliteDesigns offers a standard death benefit that provides a cash payment to your named beneficiaries if you die before annuity payments have begun or prior to the payout phase. The standard death benefit is the amount equal to your current contract value. Additionally, an optional return of premium death benefit2 is available (age 80 or younger, and must be purchased at Contract issue). This benefit is equal to the greater of the amount you paid into the contract less any withdrawals or fees, or the current contract value. This optional benefit eliminates any downside risk from the underlying funds to your death benefit.

In addition to a spousal beneficiary, you can also name a non-spousal beneficiary, including children, charities or trust. You can choose to pass your contract value down to your loved ones or to causes that are important to you by simply naming your beneficiary(ies). In doing so, your account will typically bypass probate.

Talk to your financial professional to see whether an EliteDesigns Variable Annuity can complement your retirement portfolio.

1Diversification does not assure a profit.

2Optional Return of Premium Death Benefit 0.35% Annual Fee